Botanica

Oak Hills

This syndication is fully subscribed & closed to additional investors

506c

investment for Accredited Investors only

Solo 401K

SD-IRA

QRP

BOTANICA OAK HILLS

Class A

Multifamily

Development

opportunity

LUXURY

Premier Suburban Neighborhood in a Metro with Explosive Growth

A Powerhouse Multifamily Syndication Investment in a Booming Real Estate Market

A Uniquely Resilient and Flexible Project with Wellness Amenities

Short-Term Project with Innovative No Debt Option*

3 YEARS HOLD

Project

returns

Top 10 Reasons To Learn More About Botanica Oak Hills

It is the latest Grocapitus 2.0 syndication offering with higher resilience (multiple exit strategies), multiple buyer pools, multiple audiences, and reduced construction timelines to mitigate risk in uncertain times.

The land is already zoned for multifamily, further reducing risk and the duration of the project.

It is our 3rd project with Urbanist, renowned for merging cutting-edge coronavirus resistant health & wellness initiatives with striking greenwall and boxwood design.

The project has been independently validated in a Market Study by Valbridge, the largest independent national commercial real estate valuation and advisory services firm in North America (webinar attendees will receive the market study).

We are giving investors a 10% preferred return instead of the usual 8 "pref". This means the general partners only get a piece of the returns if the limited partner investors surpass the 10% minimum return threshold.

Housing is in a full-fledged boom, that not even coronavirus could derail.

It is located in a fantastic sun-belt metro that has everything you could possibly want in an investment area - a booming population and fast growing economy, a diverse economy, a high quality of life, and a competitive cost of living.

The neighborhood is a premier suburban location in San Antonio. Botanica is adjacent to South Texas Medical Center (STMC), one of the largest Medical Centers in the U.S., and borders the prestigious Oak Hills Country Club, renowned for its championship golf course.

Every aspect of the project has been designed to maximize income and profits while providing an exceptional living experience for tenants.

Very experienced general partner team and one of the largest real estate groups in the US as management partner.

luxury community

Let’s Take A Tour Of This Absolutely Stunning Project

Oak Hills’ botanical community has been created with the highest standards of design in mind, offering the same extraordinary lifestyle experience as one would find in the most sought-after exclusive international developments, but offered at an affordable price point.Designed to be an iconic architectural “masterpiece”, Botanica Oak Hills is set to become the future benchmark for boutique multifamily values, merging cutting-edge coronavirus resistant health & wellness initiatives with striking greenwall and boxwood design.

FASTEST-GROWING REGION

Real Estate

Is In A Massive Boom

“U.S. Home Sales Rise to New 14-Year High, Offering a Boost to Economy” – Wall Street Journal

“American Housing is in a Full-Fledged Boom” – Forbes

“Fed pledges to keep interest rates near zero for years” – CNN

“Sales soar to a record high, fueled by rock-bottom mortgage rates.” – CNBC

“How 2020 broke the housing market: So many homes are selling that we could run out of new houses in months.” – Business Insider

Not enough homeowners are selling and homes are not being built fast enough to meet demand, creating a severe shortage of housing inventory.

“U.S. housing is one of the best money-making opportunities today. And with record numbers of house hunters entering the market, it all but guarantees the housing boom has YEARS left to run.” – Forbes

BEST PERFORMING

Why Invest

In San Antonio?

#1 Most Prepared for Recession

#1 Highest Income Growth (2005+)

#1 Hottest Single-Family Market

Ten-X

#2 Big City for Economic Growth Potential

Business Facilities

#2 Best City to Start a Business

WalletHub

#2 Highest Millennial Growth

Time

#3 Best Home Price Growth

#7 Largest Population in the U.S.

Forbes, 2020

The San Antonio Board of Realtors just reported a huge jump in real estate prices for the area:

“Red-hot San Antonio housing market reports whopping 32% jump in sales over Sept. 2019”

and CBRE predicts strong multifamily demand:

“2021 should experience steady recovery, and Texas’s pre-COVID-19 strengths should play a big role in helping apartment demand return rapidly through 2021.”

San Antonio has had the strongest rent performance since March of any major Texas metro and investment has come rushing into the city, both in the form of development, followed by acquisitions of new, well-leased properties.

The Oak Hills Micro Neighborhood

Nestled inside the 900 acre South Texas Medical Center and the acclaimed, 170 acre Oak Hills Golf & Country Club, Botanica Oak Hills is located in the most sought-after submarket in San Antonio. The area has direct access to upscale residential communities, retail, leisure and business.

The location is within minutes of San Antonio’s largest employers, including South Texas Medical Center (60,000 employees), USAA Headquarters (17,000), Valero Energy Headquarters (1,600). There are a staggering 800,000 high income jobs in a 30 minute driving radius.

62% of the residents are employed in white collar jobs – executive, management, office and professional occupations.

Income growth in the area is stunning at almost 11% in the last 2 years, allowing rents to be raised as incomes increase.

MEDICAL JOBS

South Texas

Medical Center (STMC)

San Antonio’s preeminent South Texas Medical Center boasts a 900-acre medical complex consisting of:

12 major hospitals

80 clinics

56,000+ jobs

over 3 million outpatients each year

STMC serves as the hub for San Antonio’s booming healthcare industry, with an annual budget of more than $2 billion.

STMC has plans for huge expansion/growth in the next 3-4 years with $947M worth of current development planned – increasing each month. STMC has received some of the largest investment contributions in South Texas, and is on the path to remarkable growth, which has only been further propelled by the onset of COVID.

It is only a 5 minute walk from Botanica Oak Hills to STMC.

Testimonials

Some of

our raving

investors

I have invested with Neal, Anna and team for years and they are excellent at what they do and return better than predicted returns. They have way exceeded expectations. What impresses me about Neal, Anna and their team is their quality research on every aspect of the market, their excellent communications and updates to investors, and their ability to add value to every property they touch.

I also appreciate their personal care about their investors and that they are accessible to discuss investments and concerns in a prompt manner. I highly recommend them for real estate investments.

I have invested in a couple of opportunities with Neal and his team. These have been performing superbly, and way better than the initial predictions even during the COVID-19 pandemic. The marketing material that the team has put together is top-notch. Awesome job by Neal and his team in managing the properties and consistent communication with their investors.

As a Limited Partner to invest in a syndication, for me, trust is a big factor. With Neal’s vast experience in multifamily construction, data-driven approach, and creative ways in solving problems as well as straightforwardness helped in creating the trust.

Neal has gone through tremendous lengths to create a great opportunity and company for maximum success for everyone together. This is a rare opportunity and company and I am grateful to be part of it.

prestigious

Oak Hills

Country Club

Adjacent to the property is the prestigious Oak Hills Country Club, providing convenient access to the clubhouse, championship golf course, tennis, pool, expansive fitness center, and upscale family dining, an element no other rental community in the area can offer. The 170 acre country club is a destination for medical students, and high earning STMC staff, doctors, nurses and executives.

Oak Hills Country Club is without a doubt one of the most respected private member-owned country clubs in the country. Oak Hills has hosted 34 PGA and USGA Tour events, with a list of winners that reads like a who’s who of golf history.

Boasting premium club facilities, recreation areas and dining, conferencing and event spaces, this world-renowned golf course increases Botanica’s commercial and cultural cachet significantly.

LUXURY

Affordable Luxury – Upscale Modern Design

Botanica Oak Hills pushes the boundaries of excellence in multifamily living. The sophisticated design incorporating botanical elements and designer finishes will give the project its own defined aura, with a combination of exquisite attractions, on par with some of the best residential communities in the nation.

This architectural dream has modern, optimized state-of-the-art amenities that are rarely found in even the most progressive multifamily or student housing developments. There is absolutely nothing like it in San Antonio.

Interior amenities include:

Fully furnished with upscale modern furniture

Large rooms with 10 & 16 ft ceilings and oversized windows

Delos healthy home system with Covid-resistant Health & Safety Certification

Washer/dryer in unit; air conditioning

Stainless steel appliances

SOHO desk space

IOTAS smart home automation

High-speed wifi

The project’s luxury design, coupled with botanical focus, wellness features and lifestyle opportunity exceeds anything in the area.

Innovative Outdoor Amenities

Botanica Oak Hills’ pioneering design proudly incorporates an array of customized, highly desirable outdoor features which will distinguish it from its competitors and will be the envy of its neighbors.

Designer pool and outdoor relaxation sundeck

Outdoor summer kitchen & bar

Lounge seating, deco swing, and trellised cabanas

Recessed firepit

Botanic design with vertical gardens, pocket parks and green wall boxwoods

Private dog park

EV charging stations

All outdoor areas are designed and durably constructed for low cost and maintenance.

WELLNESS BY DESIGN

Our Tenants’

Health Matters

At Grocapitus, we saw wellness trends in real estate a while ago, long before COVID-19 pushed them into the international spotlight. That’s why we jumped at the chance to create a Delos Darwin-driven boutique multifamily community. Delos invented the WELL Building Standard.

The system intuitively responds to the conditions in your home, purifying your air and water, and providing dynamic lighting designed to restore your body’s natural rhythms.

Purified water

Purified air

Circadian sleep

Our team realized immediately the potential for Botanica Oak Hills to attract (and keep) high-quality, upper-income tenants, both students, and professionals by incorporating a state-of-the-art home wellness system in a pandemic challenged world.

Innovative Investor-Friendly Exit Options

What really makes this investment opportunity shine and puts it in a league of its own is the flexibility we have with exit options due to the creative structure of the Grocapitus 2.0 investor-friendly product offering being used for this project.

We have 2 different exit options available to us that we will explain in the investor presentation.

In our default option, we exit the project after 3 years, and we have a creative approach that allows us to hold & operate the asset debt-free, giving us equity level returns and higher net cash flow without any debt risk.

Our alternative exit strategies provide us flexibility depending on whether the recovery is going better than we expect, or if it is taking longer than we currently anticipate.

We can’t wait to show you each exit strategy in the investor presentation!

fastest growing industry

Branded, Wellness Residence Premiums

Wellness is one of the fastest growing industries in the world, including lifestyle, exercise studios, and organic eating habits. Wellness real estate is a staggering $50 billion a year industry, just in the U.S., and properties featuring wellness can sell much faster and command impressive price premium as compared to ‘regular’ properties.

5 - 35% Premium

wellness-branded, single-family homes

7 - 10% Premium

wellness rentals

+31% Premium

average premium for branded residences (Newmark Knight Frank)

Branded developments sit at the most competitive and innovative edge of the market, with purchasers attracted by the opportunity to associate themselves with a known brand. Botanica Southpark leverages the leading wellness brand in the world, Delos.

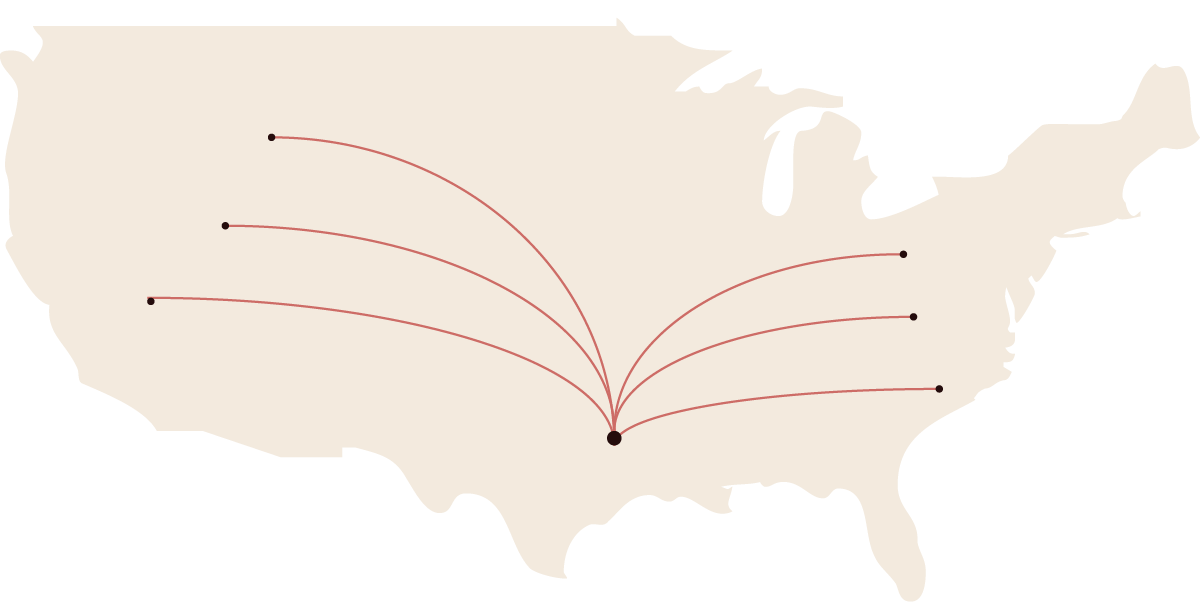

MARKET SELECTION

How we select

Development Markets

Rent Growth

The 5 year rent growth forecast is one of our key indicators. We use a powerful proprietary method to calculate this value.

Employment

We look for metros and submarkets that are adding a significant number of high-paying jobs, resulting in a stable local economy.

Sales Trends

We continuously monitor local sales to compute cap rates and determine whether our cap rates are on target to reach our projections.

Supply and Demand

We monitor the supply of local units carefully to ensure it will not spike the vacancy rates and negatively impact rents.

3 YEARS HOLD

Project

returns

This material does not constitute an offer or a solicitation to purchase securities. An offer can only be made by the Private Placement Memorandum (PPM).The PPM and its exhibits contain complete information about the Property and the investment opportunity. The information contained herein is not a substitute for an investor’s complete review of all of the information attached to the PPM as part of their own due diligence regarding this investment opportunity and its suitability for their investment portfolio.